Property Tax Texas 2025. Delinquency dates, penalty and interest by type of property tax bill. Fort worth’s proposed 2025 budget is nearly $2.6 billion.

This change reflects the evolving nature of the economy, where many transactions now occur online. A $12.7 billion package of property tax cuts goes before voters later this year, promising to deliver savings to millions of property owners in texas suffering from.

Effective january 1, 2025, the notarization requirement is eliminated for rendition statements or property reports filed on behalf of property owners when the.

The district of columbia exempted 97 percent of businesses from tpp taxes by forgoing less than 1 percent of its property tax revenue.

Commentary How Property Taxes Work Texas Scorecard, Compare that to the national average,. (meridian) — new and updated property tax information has just.

What Do Property Taxes Pay For in Texas? Where Your Taxes Go, Home » taxes » property tax » calendars. Compare that to the national average,.

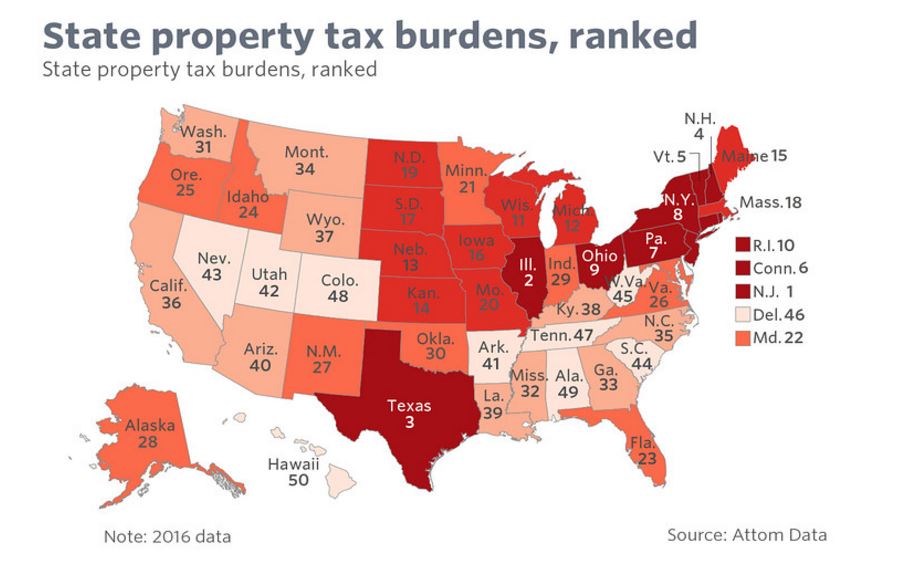

US Property Tax Comparison by State Armstrong Economics, The comptroller’s property tax assistance division provides the penalty and interest (p&i) chart below for use in calculating the total. In our continued effort to make the information from our office more.

US Property Tax Comparison By State Armstrong Economics, Mar 11, 2025, 06:00pm edt. Calendar updates we recently updated the events.

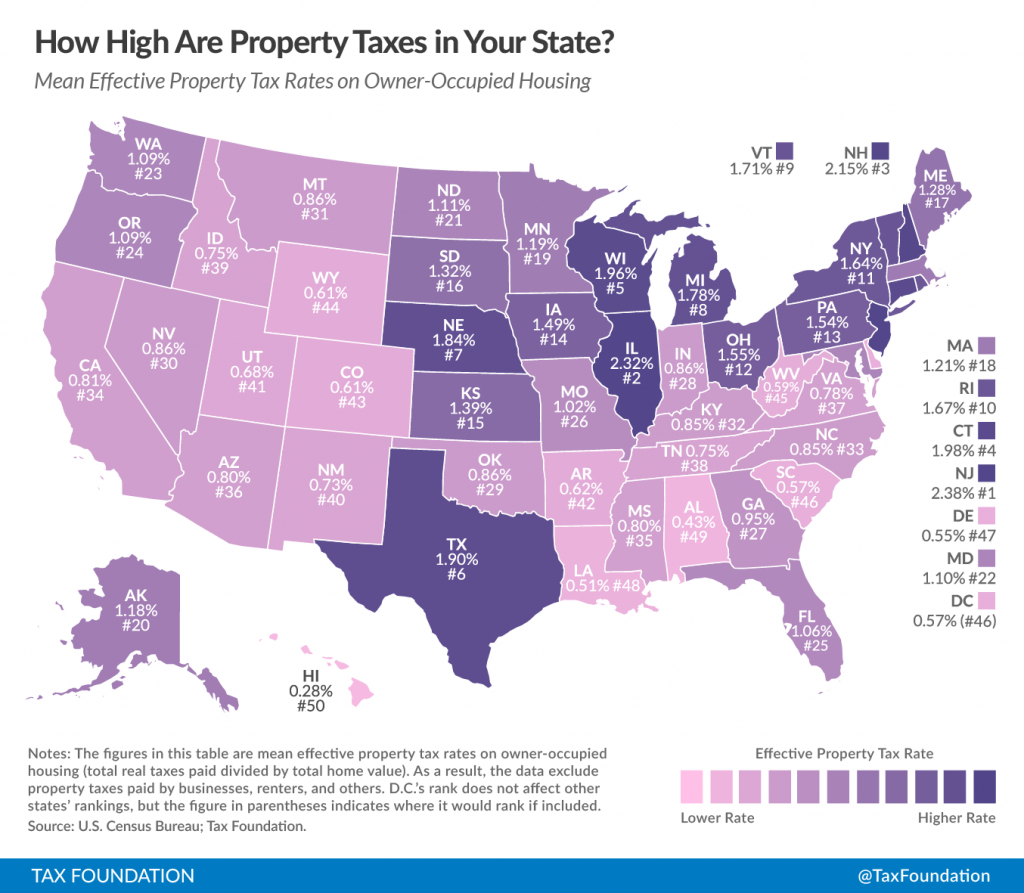

Real Estate Property Tax By State, Here's what voters approved of and who will benefit from the new law. Tax development mar 09, 2025.

Where Does Texas Rank on Property Taxes? Texas Scorecard, $18 billion benefiting texans, including more than 5.7 million texas homeowners. Property tax bills flyer (pdf) tax assessors prepare and mail bills.

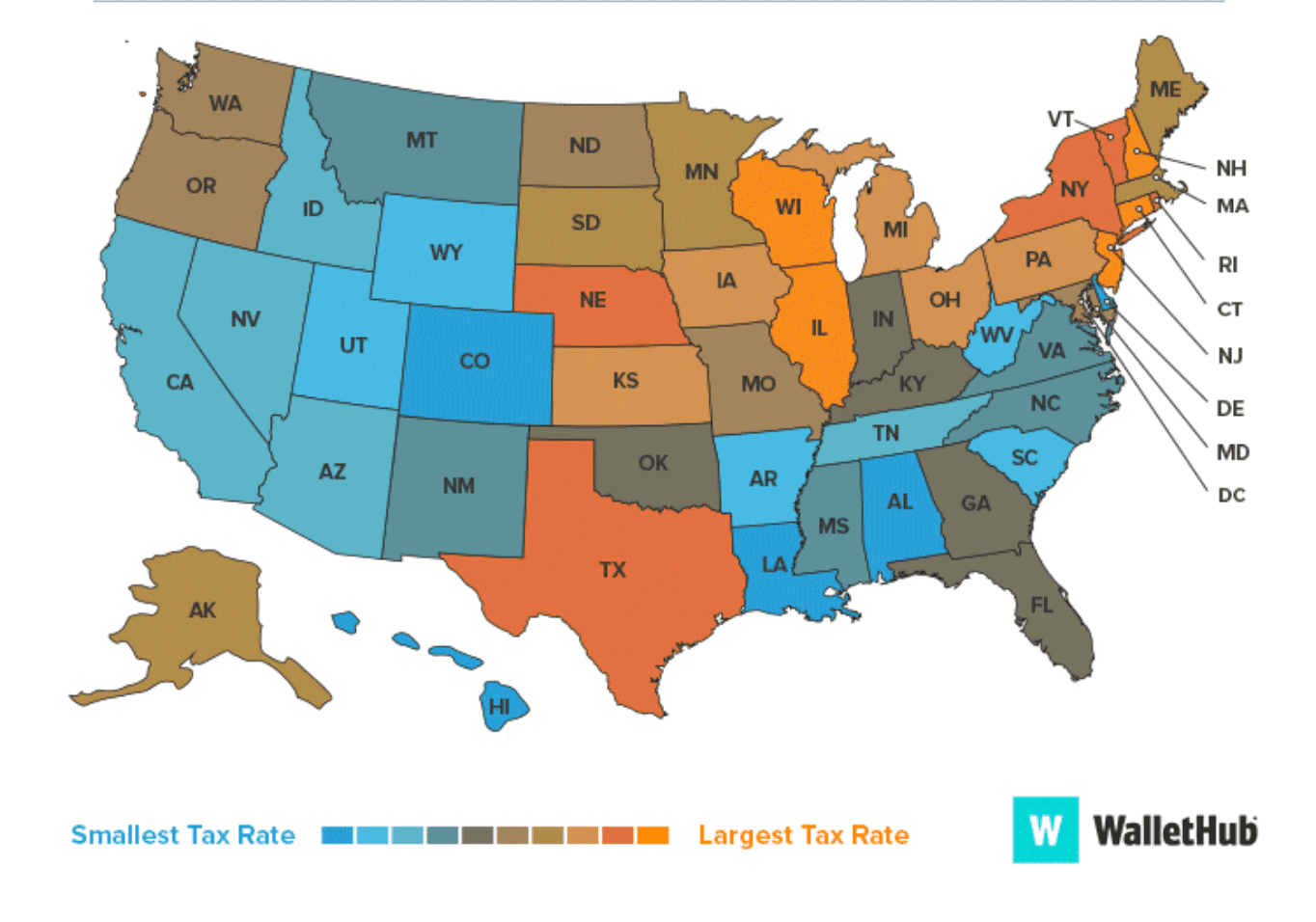

does your state impose high taxes?, I was proud to sign into law the largest property tax cut in texas history: Compare that to the national average,.

How High Are Property Taxes In Your State? Tax Foundation Texas, Our 2025 texas property tax law changes (pdf) publication summarizes property tax laws that changed due to legislation passed by the 88th legislature. What's new 2025 with texas property tax and homestead exemptions?

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, What's new 2025 with texas property tax and homestead exemptions? Fort worth’s proposed 2025 budget is nearly $2.6 billion.

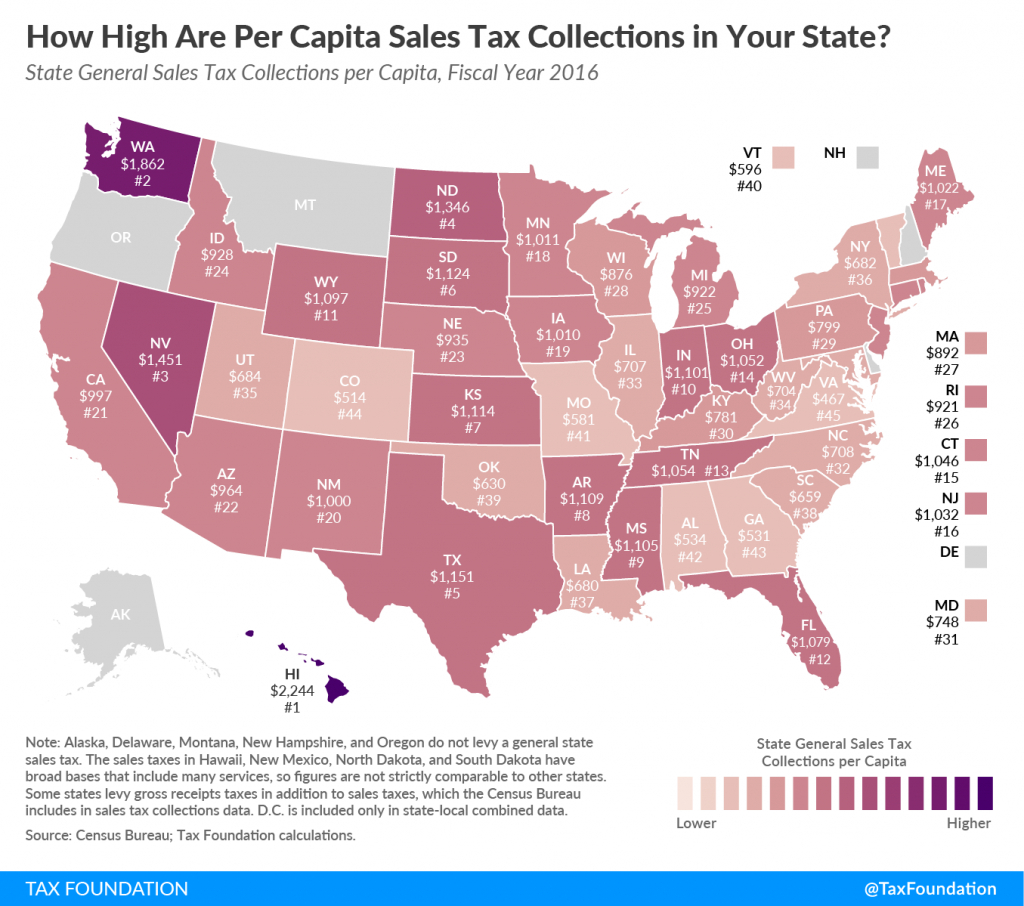

Sales Taxes Per Capita How Much Does Your State Collect? Texas, Texas taxpayers should prepare for these state tax law. Our 2025 texas property tax law changes (pdf) publication summarizes property tax laws that changed due to legislation passed by the 88th legislature.