New Retirement Rules 2025. If you're turning 73 in 2025, you can take your first rmd by dec. The secure act permits an employer to adopt a new retirement plan by the due date of their tax return for the fiscal year in which the plan is effective.

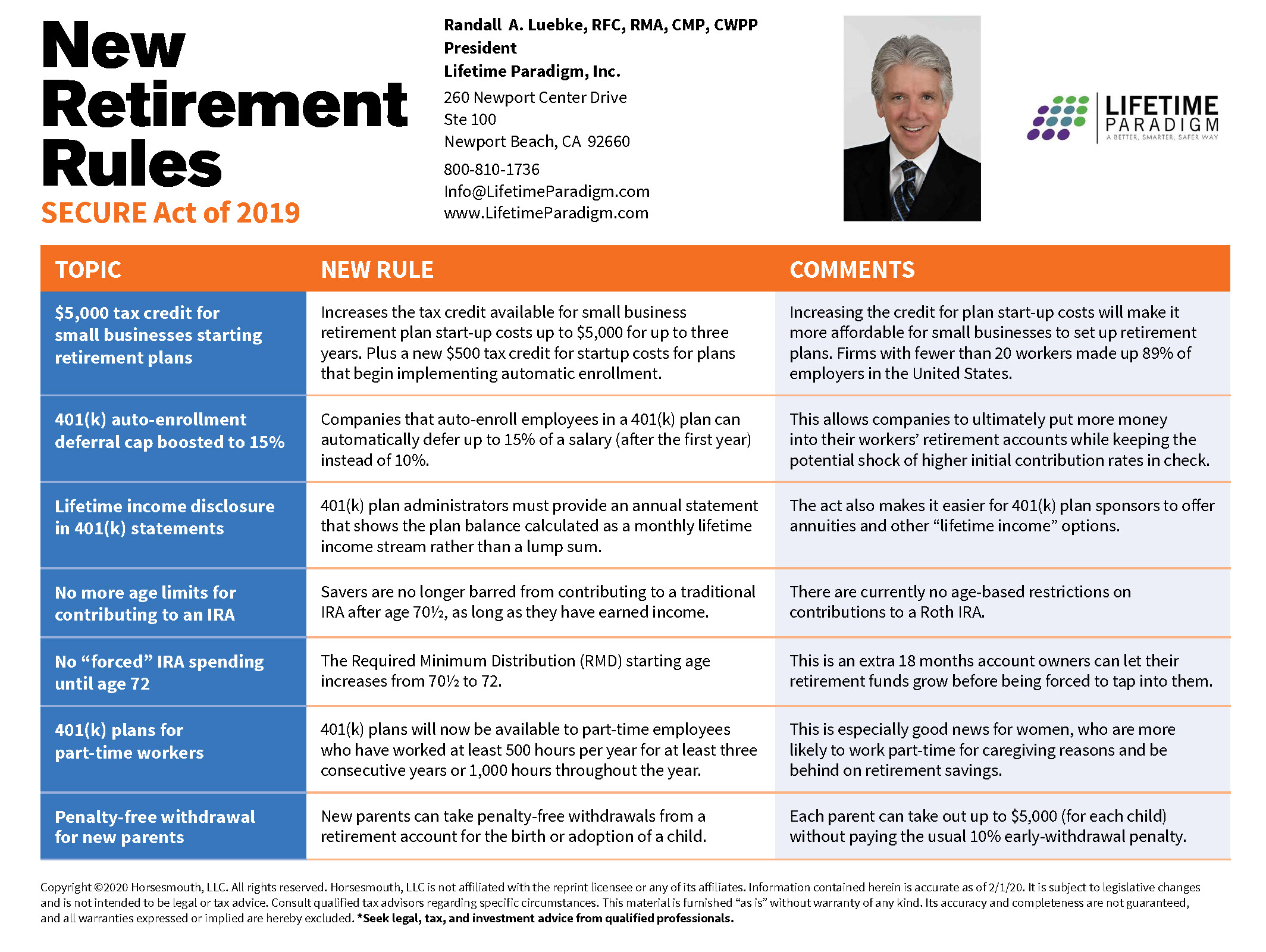

Secure 2.0 establishes two new kinds of retirement plan designs for plan years beginning after 2025, which smaller employers. Get clarity on 401 (k) auto enrollment and escalation, using financial incentives, and treating certain funds.

The new law says that starting in 2025, if you’re 60 to 63, you’ll be allowed to contribute up to $10,000 more than the standard 401(k) limit, and that amount will be.

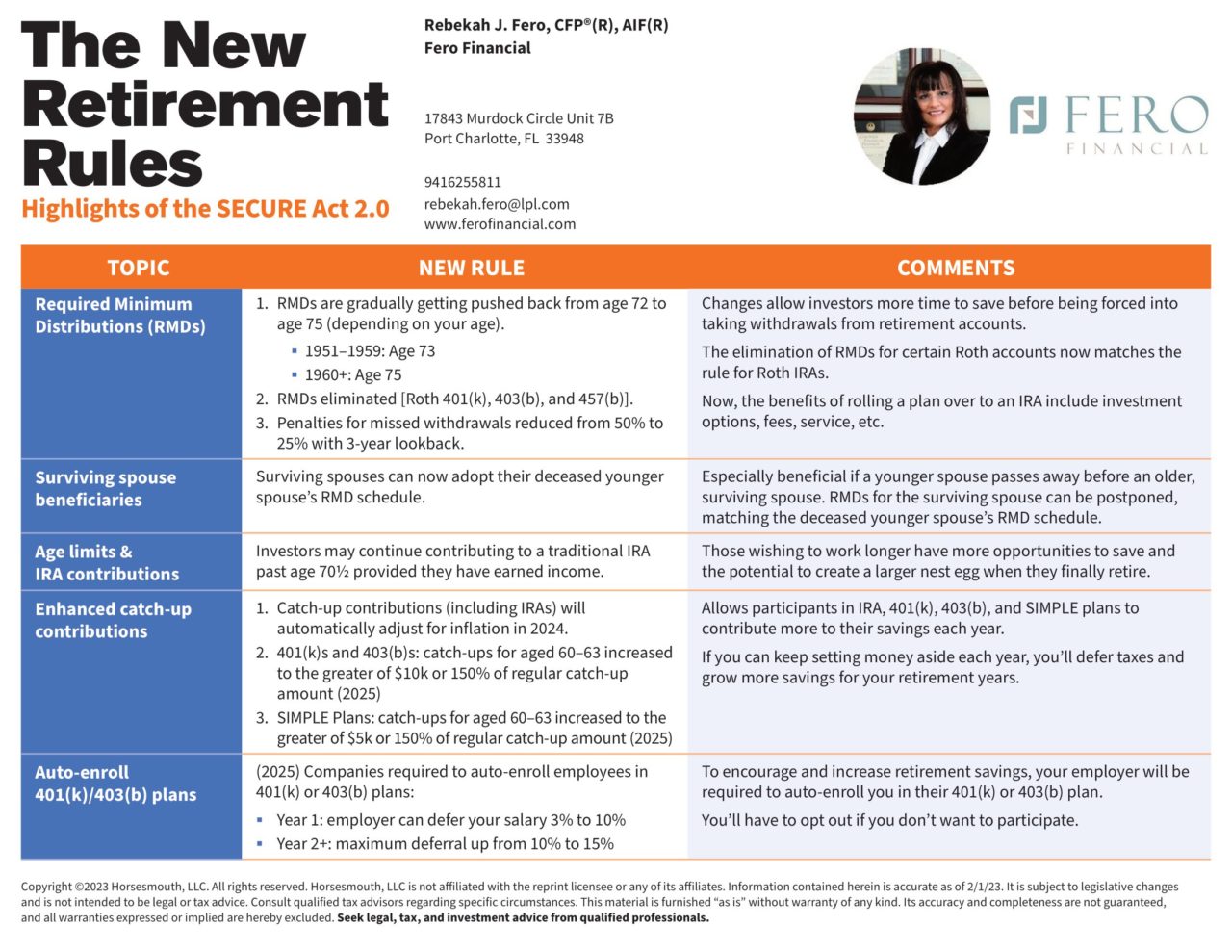

The New Retirement Rules Fero Financial, Employers who start new retirement plans after 2025 would be required under the new bill to automatically enroll workers into 401(k) or 403(b) plans by 2025 at. If you want to retire in 2025, here's what you need to prep now.

The New Retirement Rules Webinar YouTube, Beginning in 2025, employees at companies that are launching a new retirement plan would be automatically enrolled in the plan, unless they opt out, and would see their contribution amount automatically. The retirement account rule changes in the secure 2.0 act of 2025 will impact employers at least as much as employees.

New Retirement Rules Strategies for Succeeding in the Coming Economic, The rationale is that automatic enrollment in 401(k) plans has been shown to increase participation. Beginning in 2025, the secure 2.0 act expands automatic enrollment in retirement plans.

The New Rules of Retirement Medicare Life Health, Here's how to strategize withdrawals, optimize tax advantages and beat inflation ahead of a. There soon may be new retirement rules in place that could make it easier for americans to accumulate retirement savings and make it less costly to withdraw.

The New Retirement Rules SECURE Act 2.0, Department of labor has finalized its retirement security rule to protect the. Secure 2.0 establishes two new kinds of retirement plan designs for plan years beginning after 2025, which smaller employers.

The Impact of the New Retirement Rules on Your Future Savings, There soon may be new retirement rules in place that could make it easier for americans to accumulate retirement savings and make it less costly to withdraw. The secure act 2.0 would permit employers to make matching contributions to an employee’s 401(k) and 403(b) retirement plan, even if the worker isn’t saving.

New Retirement Rules Strategies for Succeeding in the, Secure 2.0 establishes two new kinds of retirement plan designs for plan years beginning after 2025, which smaller employers. On december 29, 2025, president biden signed into law the secure 2.0 act of 2025 as part of the consolidated appropriations act of 2025 (collectively, the “act”).

New Rule Would Allow ESG Considerations for Retirement Plans Graydon Law, There soon may be new retirement rules in place that could make it easier for americans to accumulate retirement savings and make it less costly to withdraw. Waiting until april 1, 2025, means you’ll.

What Are the New Rules of Retirement? 10 Guidelines for Financial, The secure act 2.0 would permit employers to make matching contributions to an employee’s 401(k) and 403(b) retirement plan, even if the worker isn’t saving. Department of labor has finalized its retirement security rule to protect the.

New Retirement Rules What you need to know about the SECURE Act, The secure act permits an employer to adopt a new retirement plan by the due date of their tax return for the fiscal year in which the plan is effective. The penalties for not following the rules can be steep, so it's best to stay up to date.

Secure 2.0 establishes two new kinds of retirement plan designs for plan years beginning after 2025, which smaller employers.

Beginning in 2025, employees at companies that are launching a new retirement plan would be automatically enrolled in the plan, unless they opt out, and would see their contribution amount automatically.