Federal Tax Brackets 2025 Canada. Which provincial or territorial tax table should you use? That’s why on april 1, the start of the next fiscal year, the carbon price will increase by $15 to $80 per tonne.

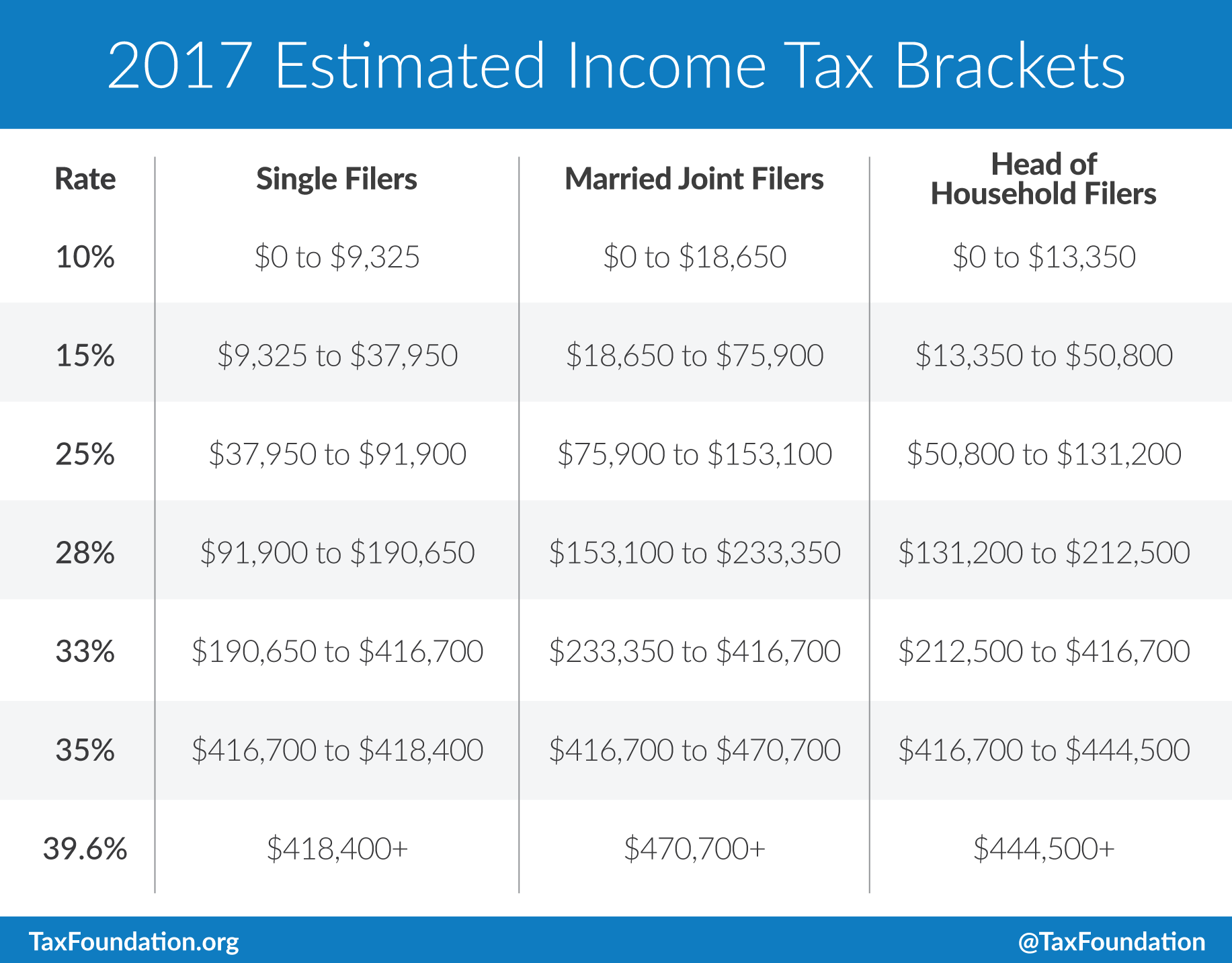

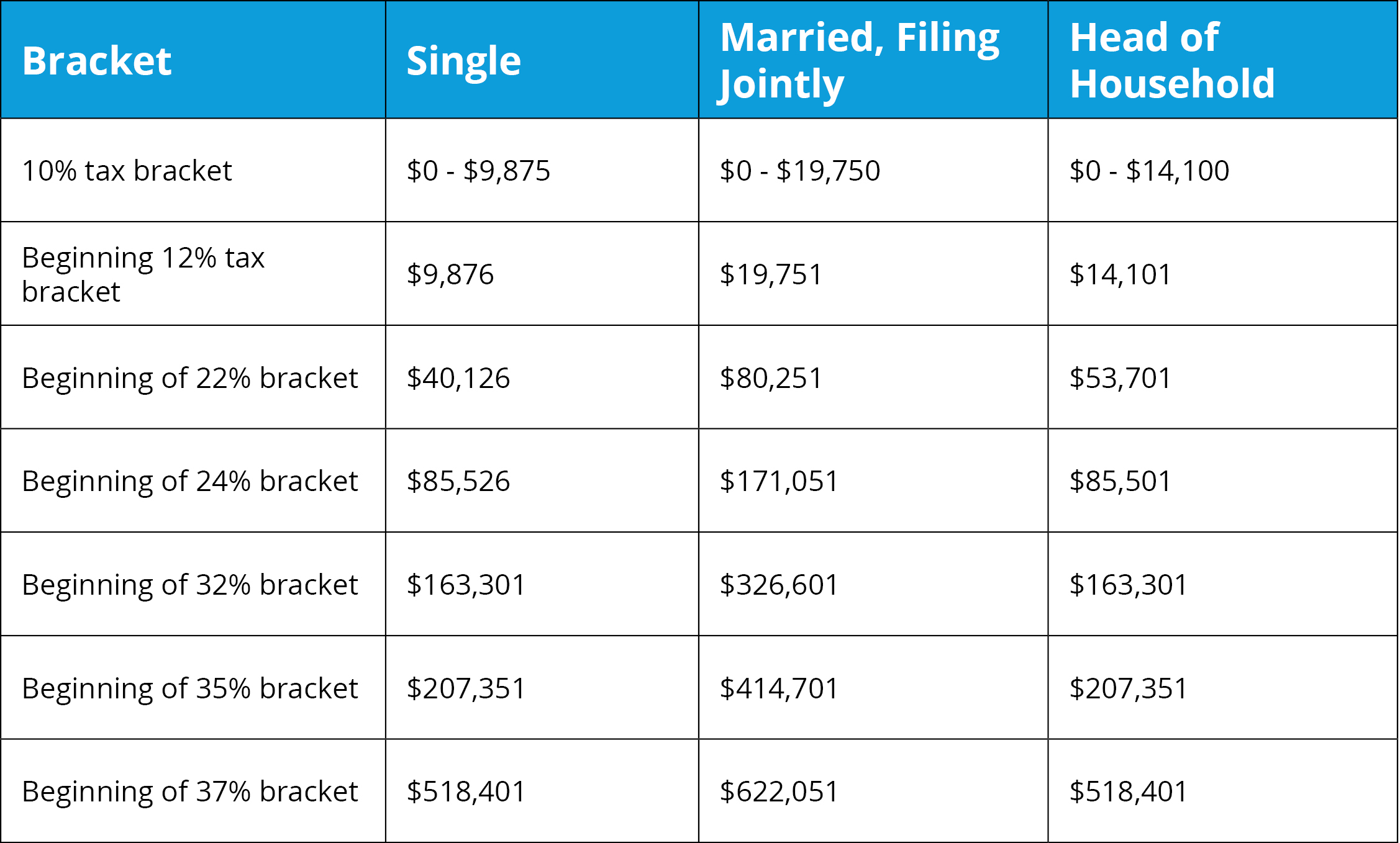

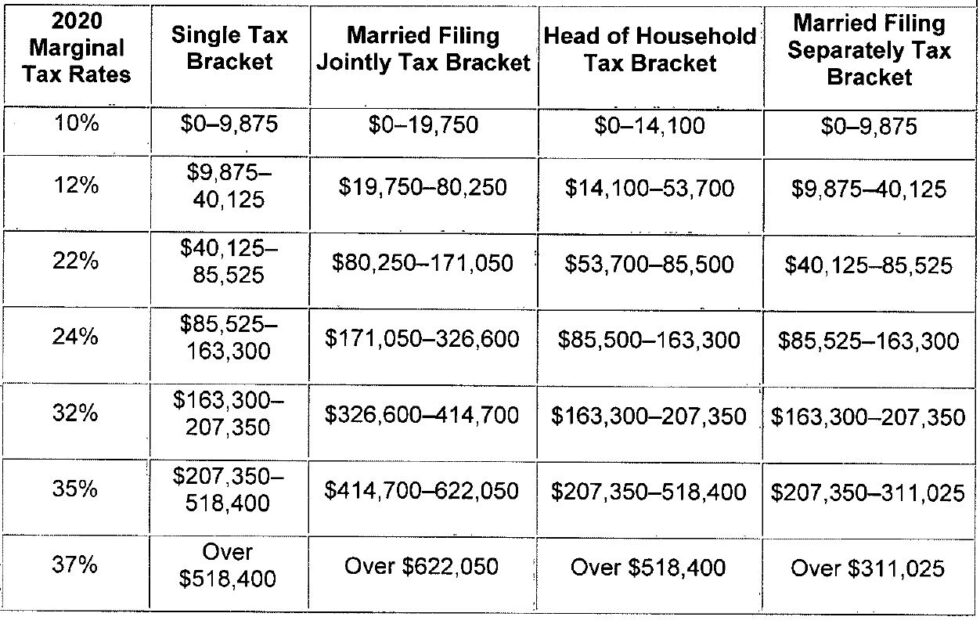

The federal income tax has seven tax rates in 2025: The federal income tax was established in 1913 with the ratification of the 16th.

To help you figure out how much you can expect to pay, here are the tax brackets, both federal and provincial, for both the 2025 and 2025 tax years.

The government is falling short on a 2025 budget commitment to pilot a new automatic tax filing program this year, experts say.

Ca tax brackets chart jokeragri, After the general tax reduction, the net tax rate is 15%. In total, that adds up to $9,227.31.

2025 Form 1040 Tax Tables Printable Forms Free Online, Choose your province or territory below to see the combined federal & provincial/territorial marginal. 14 rows the federal tax brackets and personal tax credit amounts are increased for.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, In total, that adds up to $9,227.31. The top marginal income tax.

2025 Tax Rates & Federal Tax Brackets Top Dollar, 14 rows the federal tax brackets and personal tax credit amounts are increased for. 2025) below are the 2025 federal income tax rates, compared with rates for 2025 as well.

State Individual Tax Rates And Brackets 2017 Tax Foundation, Federal and provincial/territorial income tax rates and brackets for. Key tax brackets (2025 vs.

Low Tax Rates Provide Opportunity to "Cash Out" with Dividends, The indexation increase for 2025 is 4.7 per cent, according to the canada revenue agency (cra). For example, if your taxable income (after claiming deductions).

Tax Filing 2025 Usa Latest News Update, Choose your province or territory below to see the combined federal & provincial/territorial marginal. 61 rows 5.9% on the first $50,597 or less of taxable income.

Us federal tax brackets 2025 vaultseka, Each tax bracket is a plateau, the higher you climb, the steeper the tax rate percentage. Updated on jan 26, 2025.

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, Which provincial or territorial tax table should you use? If your taxable income is less than the $53,359 threshold, your federal marginal tax rate is 15%.

2025 Marginal Tax Rates Chart Hot Sex Picture, 14 rows the federal tax brackets and personal tax credit amounts are increased for. 2025 federal income tax brackets.